SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. )

| | | | | | | | | | | | | | |

| Filed by the registrant | | | þ | |

| Filed by a party other than the registrant | o | |

| | | | | | | | |

| Check the appropriate box: |

| o | Preliminary proxy statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| þ | Definitive proxy statement | |

| o | Definitive additional materials | |

| o | Soliciting material pursuant to Rule 14a-12 | |

REINSURANCE GROUP OF AMERICA,

INCORPORATED

| | | | | | | | |

| (Name of Registrant as Specified in Its Charter) |

| | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | | | | |

| Payment of filing fee (Check the appropriate box): |

| þ | No fee required. |

| | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| | |

| (3) | Per unit price or underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| | |

| (5) | Total fee paid: |

| | |

| | |

| o | Fee paid previously with preliminary materials. |

| | |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| (1) | Amount previously paid: |

| | |

| | |

| (2) | Form, schedule or registration statement no.: |

| | |

| | |

| (3) | Filing party: |

| | |

| | |

| (4) | Date filed: |

NOTICE OF THE ANNUAL MEETING OF | | | | | | | | | | | | | | |

| | | | |

| Notice of 2024 Annual Meeting of | |

| Shareholders |

| | | |

| | | |

REINSURANCE GROUP OF AMERICA, INCORPORATED

Chesterfield, Missouri

April 13, 2023

To the Shareholders of Reinsurance Group of America, Incorporated:11, 2024

The Annual MeetingBoard of the ShareholdersDirectors of Reinsurance Group of America, Incorporated (the "Company") willis making this proxy solicitation in connection with the Company's 2024 Annual Meeting of Shareholders to be held at 2:00 p.m. on May 22, 2024, and all adjournments and postponements thereof. The Company is first making available the Company's principal executive offices locatedAnnual Report to Shareholders for the year ended December 31, 2023 and this Proxy Statement on April 11, 2024.

The close of business on March 28, 2024 has been fixed as the record date for the determination of the Company shareholders entitled to vote at the Annual Meeting. As of the record date, approximately 65,786,319 shares of common stock were outstanding and entitled to be voted at the Annual Meeting.

Information about Annual Shareholders' Meeting

Date: May 22, 2024

Time: 2:00 p.m., Central time

Place: 16600 Swingley Ridge Road, Chesterfield, Missouri 63017 on May 24, 2023, commencing at 2:00 p.m. CDT. At this meeting only holders of record of the Company's common stock at the close of business on March 31, 2023 will be entitled to vote, for the following purposes:

1.To elect eleven | | | | | | | | | | | |

| Items of Business | Board Recommendation | More Information |

| 1. | To elect all directors for a one-year term | FOR | |

| 2. | Say-on-pay: advisory vote on executive compensation | FOR | |

| 3. | To approve the adoption of an Employee Stock Purchase Plan | FOR | |

| 4. | To ratify the appointment of Deloitte & Touche as the Company's independent Auditor for 2024 | FOR | |

| 5. | To consider any other business that may properly come before the Annual Meeting or any adjournment or postponement | - | page 81 |

| See "Voting Matters - Vote Requirements" (page 9) for additional information. |

Important Notice Regarding the Availability of Proxy Materials for terms expiring in 2024;the Annual Shareholders' Meeting

2.To voteThe Company's Notice of Annual Meeting, 2024 Proxy Statement and 2023 Annual Report to Shareholders are available on the frequencyCompany's website at www.rgare.com. Information on our website does not constitute part of this Proxy Statement.

How to Cast Your Vote

Your vote is important. Please cast your vote and play a part in the future of the shareholders' advisoryCompany. Shareholders of record, who hold shares registered in their names with the Company's transfer agent, can vote regarding approvalby:

| | | | | | | | |

| | |

Internet at www.proxyvote.com | calling 1-800-690-6903 toll-free from the U.S. or Canada | mail return the signed proxy card |

Whether or not you plan to attend the Annual Meeting, we encourage you to vote and submit your proxy through one of the Company's compensation for named executive officers on a non-binding, advisory basis;

3.To vote to approvemethods above as soon as possible so that your shares may be represented at the compensation of the Company's named executive officers on a non-binding, advisory basis;

4.To ratify the appointment of Deloitte & Touche LLP as the Company's independent auditor for the year ending December 31, 2023; and

5.To transact other business, if any, properly brought before the meeting.

| | | | | |

| |

| By | |

| Stephen T. O’Hearn,O'Hearn, Chair of the Board |

| |

| William L. Hutton, Secretary |

| | | | | |

TABLE OF CONTENTSTable of Contents | |

| | |

| Page No. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | |

TABLE OF CONTENTSTable of Contents | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PROXY STATEMENT SUMMARYProxy Statement Summary

These proxy materials are being provided to you because the Company's Board of Directors is soliciting your proxy to vote your shares at the Company's 20232024 Annual ShareholdersShareholders'’Meeting. This summary highlights information contained elsewhere in this proxy statement ("Proxy Statement"). This summary does not contain all of the information that you should consider and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find additional information in this Proxy Statement. This Proxy Statement and the related proxy materials were first made available to shareholders and on the Internet on April 13, 2023.11, 2024.

Annual Shareholders' Meeting

Date & Time: May 24, 2023,22, 2024, 2:00 p.m., Central time

Place: 16600 Swingley Ridge Road, Chesterfield, Missouri 63017

Record Date: Close of business on March 31, 202328, 2024

Voting Matters and Board Recommendations

| | | | | | | | | | | | | | | | | |

ProposalItems of Business | Board Recommendation | Voting Options | Vote Required to Adopt the Proposal | More Information |

| 1. | Election of DirectorsTo elect all directors for a one-year term | FOR all nominees | For, against or abstain for each nominee | If a quorum is present, the vote required

to elect each director is a majority of the

common stock represented in person or by

proxy at the Annual Meeting. | |

| 2. | Frequency of Shareholders’ VoteSay-on-pay: advisory vote on Executive Compensationexecutive compensation | ANNUAL | 1 year, 2 years, 3 years or abstain | If a quorum is present, the vote required to approve Item 2 is a majority of the common stock represented in person or by proxy at the Annual Meeting.FOR | |

| 3. | Shareholders’ Advisory Vote on Executive CompensationTo approve the adoption of an Employee Stock Purchase Plan | FOR | For, against or abstain | If a quorum is present, the vote required

to approve this Item is a majority of the common

stock represented in person or by

proxy at the Annual Meeting. | |

| 4. | RatificationTo ratify the appointment of Appointment of IndependentDeloitte & Touche as the Company's independent Auditor for 2024 | FOR | For, against or abstain | If a quorum is present, the vote required

to approve this Item is a majority of the common

stock represented in person or by

proxy at the Annual Meeting. | |

5. | To consider any other business that may properly come before the Annual Meeting or any adjournment or postponement | - | page 81 |

See "Additional Information"Voting Matters - Voting"Vote Requirements" (page 85)9) for additional information. |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

How to Cast Your Vote

Your vote is important. Please cast your vote and play a part in the future of the Company. Shareholders of record, who hold shares registered in their names with the Company's transfer agent, can vote by:

| | | | | | | | |

| | |

Internet at www.proxyvote.com | calling 1-800-690-6903 toll-free from the U.S. or Canada | mail return the signed proxy card |

Board Responsiveness

The Board of Directors was disappointed by the 2022 shareholder advisory vote on executive compensation ("Say on Pay"). In response to the results of the Say on Pay vote at the 2022 Annual Meeting, we reached out to investors earlier than in prior years to receive and incorporate feedback into the discussions and decisions of the Human Capital and Compensation Committee (the "Committee") for 2023. In the fall and winter of 2022, we contacted shareholders collectively representing 64% of outstanding shares and had substantive conversations with shareholders representing 34% of outstanding shares. The Chair of the Committee participated in several discussions with shareholders, and in a conversation with Institutional Shareholder Services.

| | | | | | | | |

| Offered engagement with approximately | Direct one-on-one discussions with approximately | HC&C Committee Chair participated in calls with stockholders representing approximately |

| 64% | 34% | 29% |

| of outstanding shares | of outstanding shares | of outstanding shares |

In these conversations, shareholders overwhelmingly expressed strong support and appreciation for our executive compensation philosophy, as well as an understanding of the rationale for the actions by the Committee in light of the impact of COVID-19 on our business. The following table summarizes feedback we received from shareholders, our actions in response, as well as the impact of those actions:

| | | | | | | | | | | | | | |

Shareholder Feedback

("What We Heard")

| Our Action

("What We Did")

| Impact of Action

("Why This is Important")

|

2021 One-time Grants | While expressing a preference for avoidance of one-time grants, shareholders understood the rationale for the one-time grants we made in 2021, and wanted to understand the Committee's approach to future extraordinary circumstances. | The Compensation Committee affirmed its commitment to not make discretionary, one-time awards to our named executive officers like those made in 2021 in response to the COVID-19 pandemic, absent extraordinary circumstances as determined by the Board. | Aligns with our Executive Compensation Philosophy, and clarifies our approach to extraordinary circumstances. |

Pay-for-Performance | Shareholders expressed preference for emphasis on performance-based equity. | Increased performance contingent ("PCS") awards as a percentage of long-term incentive ("LTI") awards. For 2023: | Ensures that executives’ long-term interests as well as equity payouts earned are closely aligned with long-term Company performance. |

| Ms. Manning – 100% of LTI awards in PCS;

Mr. Cheng – 75% of LTI awards in PCS; and

Other NEOs – 60% of LTI awards in PCS.

|

Shareholders expressed preference for multi-year performance periods. | Returned to our historical practice of 3-year performance metrics for 2022-2024 and 2023-2025 PCS Plans in line with our commitment in 2022; we intend to retain this structure. | Extends performance periods to 3 years, and focuses executives on long-term shareholder value creation. |

Shareholders expressed preference for incorporating peer-relative performance metrics. | Adopted a relative total shareholder return modifier for our 2022-2024 PCS; we retained this modifier for the 2023-2025 PCS awards. | Enhances performance equity design to better align outcomes with outperformance relative to peers. |

Disclosure | Shareholders encouraged additional transparency regarding award metrics. | Updated disclosure of award metrics to provide additional transparency;

Enhanced disclosure of the Strategic Scorecard metrics and evaluation methodology.

| Increases transparency of disclosure. |

Senior Management Update

The Company announced the appointment of Tony Cheng as President of the Company, effective January 4, 2023. At that time, the Company also announced that Anna Manning, our Chief Executive Officer, would retire on December 31, 2023, to be succeeded by Mr. Cheng.

Board Updates

Since the 2022 annual meeting, the updates to the Company's board of directors include:

•Khanh T. Tran was appointed to the Board as an independent director, effective July 1, 2022. Mr. Tran is the retired President and Chief Executive Officer of Aviation Capital Group LLC, and previously held various executive positions with Pacific Life.

•As previously announced, J. Cliff Eason, independent Chair, retired from the Board as of December 31, 2022.

•Independent director Stephen T. O'Hearn was appointed Chair of the Board on January 1, 2023.

•In connection with his appointment as Company President and as part of executive succession planning, Mr. Cheng was appointed to the Board on January 4, 2023.

•On March 9, 2023, Ng Keng Hooi informed the Board that he will not stand for re-election at the Annual Meeting. Mr. Ng's decision not to stand for re-election is not the result of any dispute or disagreement with the Company, the Company's management or the Board on any matter relating to the Company's operations, policies or practices.

| | | | | | | | | | | | | | |

Board Nominees (page 2)11) |

| | Name | Name | Director Since | Independent | Election for Term Ending | Committee Memberships | Name | Director Since | Independent | Election for Term Ending | Committee Memberships |

| Pina Albo | Pina Albo | 2019 | Yes | 2024 | Human Capital and Compensation

Investment

Nominating and Governance | Pina Albo | 2019 | Yes | 2025 | Human Capital and Compensation

Investment

Nominating and Governance |

| Michele Bang | | Michele Bang | 2023 | Yes | 2025 | Audit

Cybersecurity and Technology

Risk |

| Tony Cheng | Tony Cheng | 2023 | No | 2024 | None | Tony Cheng | 2023 | No | 2025 | None |

| John J. Gauthier | John J. Gauthier | 2018 | Yes | 2024 | Audit

Investment, Chair

Risk | John J. Gauthier | 2018 | Yes | 2025 | Human Capital and Compensation

Investment, Chair

Risk |

| Patricia L. Guinn | Patricia L. Guinn | 2016 | Yes | 2024 | Audit, Chair

Investment

Risk | Patricia L. Guinn | 2016 | Yes | 2025 | Audit, Chair

Investment

Nominating and Governance |

| Anna Manning | 2016 | No | 2024 | None |

| Hazel M. McNeilage | Hazel M. McNeilage | 2018 | Yes | 2024 | Human Capital and Compensation, Chair

Nominating and Governance | Hazel M. McNeilage | 2018 | Yes | 2025 | Cybersecurity and Technology

Human Capital and Compensation, Chair

Risk |

| George Nichols III | George Nichols III | 2022 | Yes | 2024 | Human Capital and Compensation

Nominating and Governance | George Nichols III | 2022 | Yes | 2025 | Cybersecurity and Technology

Human Capital and Compensation

Nominating and Governance |

| Stephen O'Hearn (Chair) | Stephen O'Hearn (Chair) | 2020 | Yes | 2024 | None | Stephen O'Hearn (Chair) | 2020 | Yes | 2025 | None |

| Alison Rand | | Alison Rand | 2024 | Yes | 2025 | None |

| Shundrawn Thomas | Shundrawn Thomas | 2021 | Yes | 2024 | Human Capital and Compensation

Nominating and Governance, Chair | Shundrawn Thomas | 2021 | Yes | 2025 | Human Capital and Compensation

Investment

Nominating and Governance, Chair |

| Khanh T. Tran | Khanh T. Tran | 2022 | Yes | 2024 | Audit

Investment

Risk, Chair | Khanh T. Tran | 2022 | Yes | 2025 | Audit

Investment

Risk, Chair |

| Steven C. Van Wyk | Steven C. Van Wyk | 2019 | Yes | 2024 | Audit

Risk | Steven C. Van Wyk | 2019 | Yes | 2025 | Audit

Cybersecurity and Technology, Chair

Risk |

Board and Committees (page 1720) | | Number of Members | Percent Independent | Number of Meetings in 2022 |

| Number of Members | | | Number of Members | Percent Independent | Number of Meetings in 2023 |

| Full Board | Full Board | 12 | 83% | 8 | Full Board | 12 | 92% | 18 |

| Audit | Audit | 4 | 100% | 8 | Audit | 4 | 100% | 12 |

| Cybersecurity and Technology | | Cybersecurity and Technology | 4 | 100% | 6 |

| Human Capital and Compensation | Human Capital and Compensation | 5 | 100% | 7 | Human Capital and Compensation | 5 | 100% | 7 |

| Investment | Investment | 4 | 100% | 4 | Investment | 5 | 100% | 4 |

| Nominating and Governance | Nominating and Governance | 5 | 100% | 5 | Nominating and Governance | 4 | 100% | 4 |

| Risk | Risk | 4 | 100% | 4 | Risk | 5 | 100% | 4 |

| As of April 1, 2023. | |

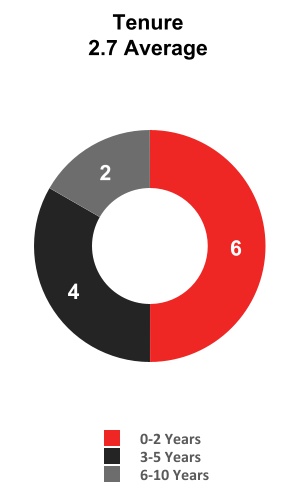

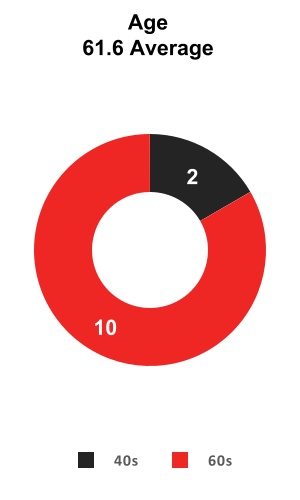

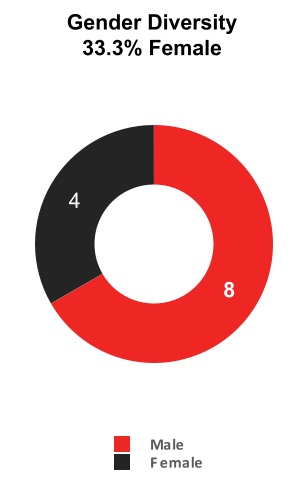

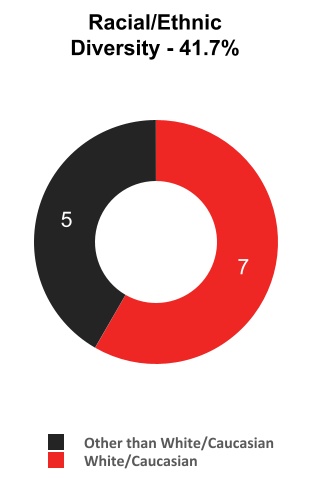

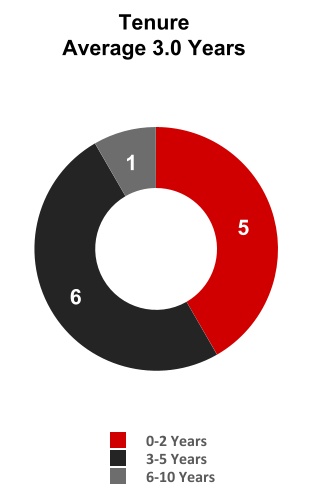

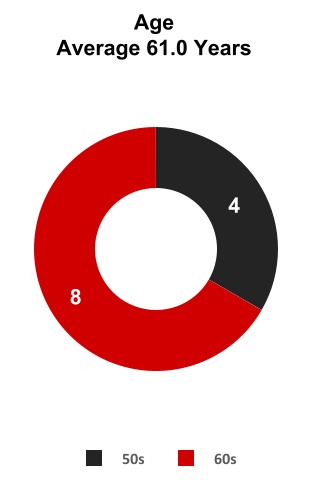

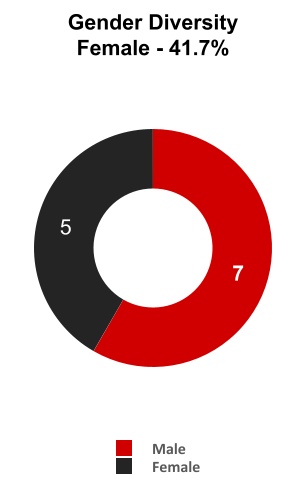

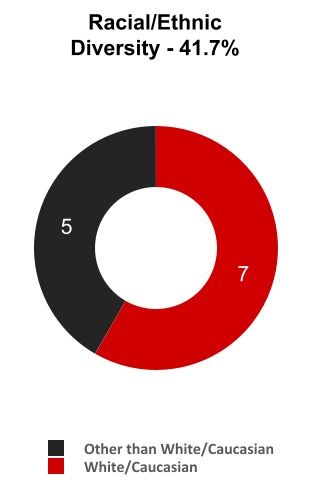

Board Diversity Snapshot

| | | | | | | | | | | | | | |

Governance Facts (page 12) |

| | | | | |

| Board Composition and Structure: | |

| Size of Board | 12 |

| Number of Independent Directors | 1011 |

| New Directors Appointed Since 2019 | 89 |

| Independent Chair | Yes |

| All Committees Comprised Entirely of Independent Directors | Yes |

Independent Chair | Yes |

Separate Chair and CEO | Yes |

| Regular Board and Committee Assessments | Yes |

| Accountability to Shareholders: | |

| Annual Director Elections | Yes |

| Majority Voting for Director Elections | Yes |

| Proxy Access | Yes |

| Supermajority Vote Provisions | No |

| Shareholder Rights Plan (Poison Pill) | No |

| Advisory Vote on Executive Compensation | Annual |

| Alignment of Interests with Shareholders: | |

| Robust Stock Ownership Guidelines for Directors and Executive Officers | Yes |

| Restrictions on Hedging and Pledging of Company Shares for Directors and Employees | Yes |

Executive Incentive Recoupment (Clawback) PolicyPolicies (mandatory NYSE policy and additional voluntarily adopted policy) | Yes |

| As of April 1, 2023. |

Chief Executive Officer

On December 31, 2023, Anna Manning, our former Chief Executive Officer, retired. Tony Cheng, our President since January 2023, assumed the role of Chief Executive Officer on January 1, 2024.

COVID-19 Impact and Paying for Performance

The COVID-19 pandemic and the response thereto had a significant impact on the Company and its clients in recent years. The "COVID-19 Impact and Paying for Performance" section in the Compensation Discussion and Analysis ("CD&A") describes the impact of the COVID-19 pandemic on the Company and actions taken by the Human Capital and Compensation Committee (the "Committee") in

light of the pandemic and specific challenges to the life insurance industry. The following is a summary of that discussion.

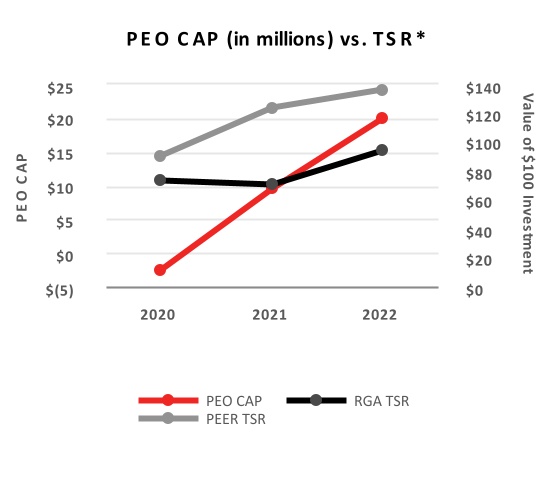

Recent Company Performance

In 2020, 2021 and 2022, RGA absorbed an estimated $2.4 billion of COVID-19 related impacts. Despite the magnitude of COVID-19 claims paid during this three-year period, the underlying strength of our business allowed RGA to produce meaningful earnings throughout the pandemic. More importantly, our resilient business model enabled our client partners to support their policyholders amid widespread uncertainty and loss.

The following table summarizes key financial results for the years 2019 through 2022, including the estimated impact of COVID-19 on results:

| | | | | | | | | | | | | | | | | | | | |

| Year | Pre-tax adjusted operating income1 | COVID-19 Impact2 | Adjusted operating income per share1 | COVID-19 Impact2 | Trailing 12 month adjusted operating return on equity1 | COVID-19 Impact2 |

| 2019 | $1,099 million | - | $13.35 | - | 10.5% | - |

| 2020 | $627 million | $590 million | $7.54 | $6.80 | 5.7% | 5.0% |

| 2021 | $121 million | $1,362 million | $1.13 | $15.20 | 0.8% | 10.1% |

| 2022 | $1,261 million | $447 million | $14.43 | $5.02 | 10.3% | 1.5% |

1See "Use of Non-GAAP Financial Measures" on page 89 for reconciliations from GAAP figures to adjusted operating figures. |

2COVID-19 impact estimates include mortality and morbidity claims of approximately $720 million in 2020, with offsetting impacts from longevity of approximately $33 million, and approximately $97 million of expense savings, all tax effected at 24%. COVID-19 impact estimates include mortality and morbidity claims of approximately $1,416 million in 2021 and $453 million in 2022, with offsetting impacts from longevity of approximately $54 million in 2021 and $6 million in 2022; all tax effected at 24%. |

During 2020 and 2021, the Company delivered strong profitability, excluding COVID-19 impacts, and continued to add to the underlying earnings power of the business by deploying a record amount of capital into in-force and other transactions in 2021. This helped to generate record profitability in 2022 and the Company expects to deliver additional profitability in the future.

COVID-19 Impact on Compensation

As disclosed in the proxy statements for the previous two annual meetings of shareholders, the COVID-19 pandemic had a significant impact on compensation, including:

•While compensation decisions were made too early in 2020 for the Company to fully ascertain the significant impact of COVID-19 on Company performance, salaries and incentive targets for senior executives were held flat in 2021.

•The 2020 and 2021 Company-wide Annual Bonus Plan ("ABP") results both paid out below target, at 80.0% and 81.1% of target, respectively.

•Performance Contingent Share ("PCS") awards granted in 2018, 2019 and 2020 all had a 0% payout primarily as a result of COVID-19 and the Committee's decision to make no adjustments to the performance metrics and goals to PCS awards that were already outstanding. Historically, PCS grants represented 75% of equity grants for our named executive officers.

•The decline in the Company's stock price eliminated the value of recently granted stock appreciation rights ("SARs"). As of March 2021, all SARs granted from 2017 to 2019 were under water.

As a result of this unprecedented situation and as disclosed in the proxy statements for the previous two annual meeting of shareholders, in March 2021 the Committee determined that a one-time equity award to named executive officers and other executives was necessary for the engagement

of our executive team to advance our strategic objectives and to recognize the performance of our leaders in navigating the Company through the COVID-19 pandemic.

Realized and Realizable CEO Pay

Given the design of our long-term incentives, Company executives do not realize the full value of their target total direct compensation opportunity unless the Company meets or exceeds critical financial and strategic objectives, and the Company's stock price appreciates. The Committee believes the realizable compensation (as defined below) for our executives, including that for our CEO, Ms. Manning, more accurately describes the compensation they actually realize, as compared to the amounts in the Summary Compensation Table and Outstanding Equity Awards at 2022 Year End Table, because such tables do not take into account the actual or expected payouts of equity awards.

The following table displays Ms. Manning's target total direct compensation and realizable compensation since she became CEO at the beginning of 2017. "Target total direct compensation" is comprised of:

•base salary;

•annual bonus plan (ABP) grants;

•restricted share unit grants;

•performance contingent awards grants; and

•stock appreciation rights grants.

"Realizable compensation" is comprised of:

•actual annual base salary received;

•ABP payouts received; and

•the estimated value of vested and unvested equity awards as of December 31, 2022.

Over the six-year period detailed below, Ms. Manning's average realized/realizable compensation is 84% of her target compensation, compared to a total shareholder return of 26% over the same time period for the Company's shareholders.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| REALIZABLE CEO PAY |

| Target Pay1 | Realized/Realizable Actual Pay2 |

| Year | Base Salary | Target Bonus $ | Target LTI | One-Time LTI | Target Total Compensa-tion | Base Salary | Bonus Payout | Realizable/Realized Regular LTI | One-Time LTI | Actual Total Compensa-tion |

| 2022 | $1,030,000 | $2,060,000 | $6,250,000 | $0 | $9,340,000 | $1,030,000 | $3,374,547 | $8,070,854 | $0 | $12,475,401 |

| 2021 | $1,030,000 | $1,854,000 | $5,750,000 | $7,000,000 | $15,634,000 | $1,030,000 | $1,504,315 | $5,288,079 | $7,709,803 | $15,532,197 |

| 2020 | $1,030,000 | $1,854,000 | $5,750,000 | $0 | $8,634,000 | $1,030,000 | $1,390,500 | $2,312,205 | $0 | $4,732,705 |

| 2019 | $1,030,000 | $1,545,000 | $4,500,000 | $0 | $7,075,000 | $1,025,385 | $2,144,954 | $0 | $0 | $3,170,339 |

| 2018 | $1,000,000 | $1,500,000 | $3,750,000 | $0 | $6,250,000 | $992,308 | $1,308,840 | $0 | $0 | $2,301,148 |

| 2017 | $950,000 | $1,235,000 | $3,245,000 | $0 | $5,430,000 | $950,000 | $2,400,574 | $2,451,100 | $0 | $5,801,674 |

| Avg. 2017 - 2022 | $1,011,667 | $1,674,667 | $4,874,167 | N/A | $8,727,167 | $1,009,616 | $2,020,622 | $3,020,373 | N/A | $7,335,577 |

1Average of base salary earned, target ABP opportunity, and long-term incentive value granted from 2017 through 2022. |

2Average of base salary earned, actual ABP payout received, the value of vested/exercised long-term incentive awards, and the estimated current value of unvested/unexercised long-term incentive awards granted from 2017 through 2022, calculated as: |

| ● | Vested/exercised stock appreciation rights (SARs) and performance contingent shares (PCS) units are valued at time of vesting or exercise, using a performance factor of 131.5% for the completed 2017-2019 cycle, and a factor of 0% for the 2018-2020, 2019-2021 and 2020-2022 cycles and a performance factor of 100% for the one-time performance share unit (PSU) award. PCS and PSU payouts include reinvestment of additional units received as dividend-equivalents. |

| ● | Unvested/unexercised SARs are valued based on the spread value between the exercise price and $142.09, the closing price of RGA's shares as of December 31, 2022. |

| ● | Open-cycle performance contingent awards are included assuming target (100%) payouts for the 2021-2023 and 2022-2024 PCS cycles. |

The table above shows that, including the one-time LTI equity award and the zero payouts for the 2018-2020, 2019-2021 and 2020-2022 PCS awards, Ms. Manning's average actual realizable compensation over her six-year tenure as CEO was 84% of target. The Committee believes this is a reasonable outcome that appropriately balances Ms. Manning's exceptional leadership with the impact of the COVID-19 pandemic on shareholder returns. In what is a long-term business, the Committee believes that the strong financial results in 2022 demonstrate the underlying strength of the Company's franchise, which has been preserved and strengthened by Ms. Manning's leadership.

The Committee believes that the Company's strong performance in 2022, despite a $447 million impact on pre-tax adjusted operating income due to COVID-19, supports the Committee's decision to make the one-time grant of equity to Ms. Manning and other executives, in addition to the following considerations:

•the Company's strong economic performance prior to the COVID-19 pandemic, the results of which were negated in performance-based long-term incentive awards that would have paid-out during the pandemic;

•Ms. Manning's leadership during the COVID-19 pandemic, which helped the Company generate meaningful new business during the pandemic and strongly positions the Company for future success;

•the Committee's recognition that the design of certain elements of the Company's incentive compensation program (e.g., using absolute financial metrics, not comparing results to Company peers, and relatively narrow ranges between minimum, target and maximum payout thresholds for the financial metrics that determine payouts) did not fairly compensate employees during stress scenarios such as a pandemic; and

•the desire to retain Ms. Manning and other senior executives receiving the one-time equity award.

| | | | | | | | | | | | | | | | | |

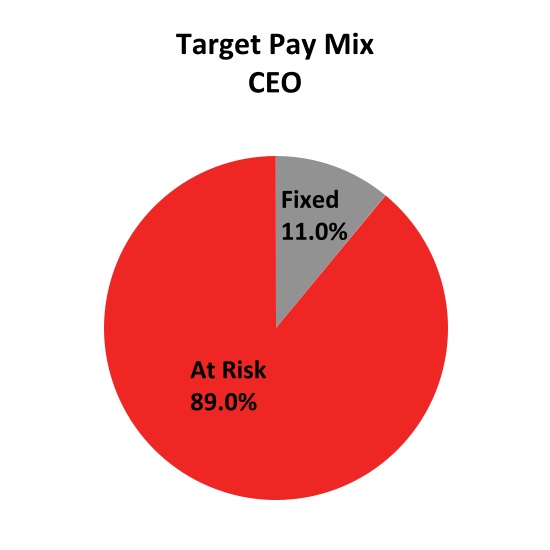

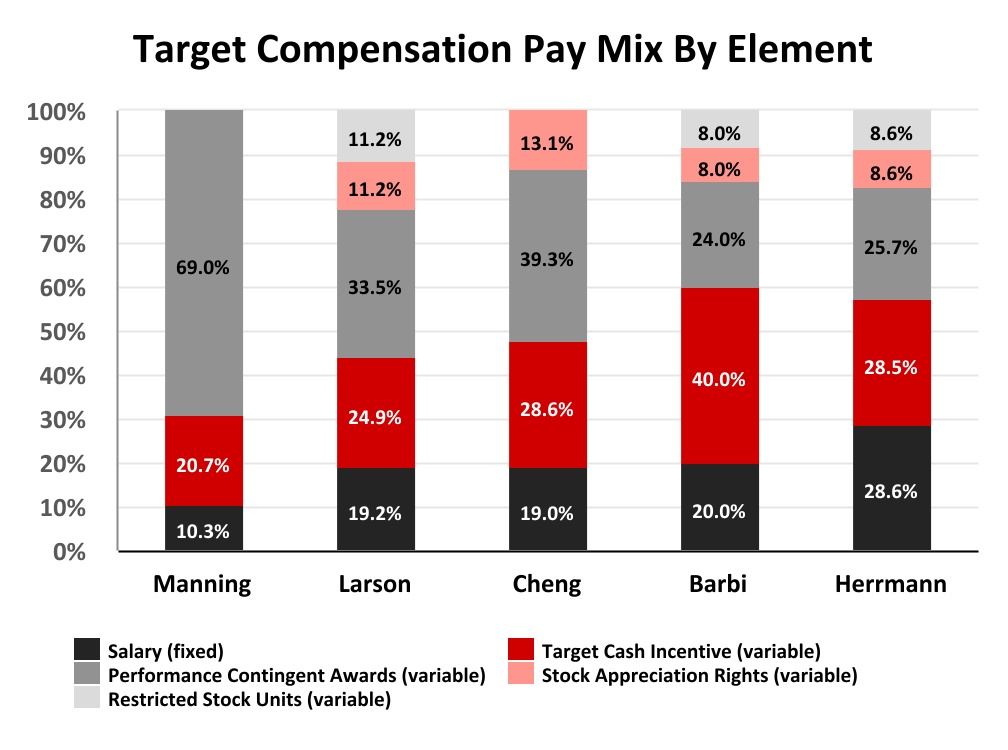

Five Elements of Executive Compensation (page 3640) |

| | | | | |

| Element | Form | Key Features |

| 1. | Base Salary | Cash | ● | FixedThe only fixed compensation element, intended to attract and retain top talent. |

| ● | Generally, we target base salary around the median of our peer companies, but this varies with individual skills, experience, responsibilities, performance and location. |

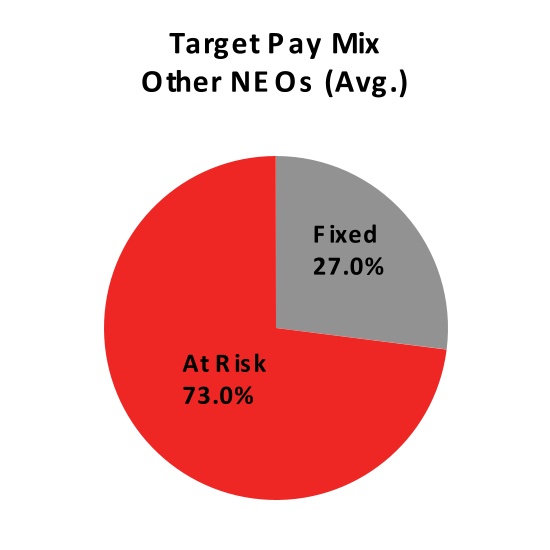

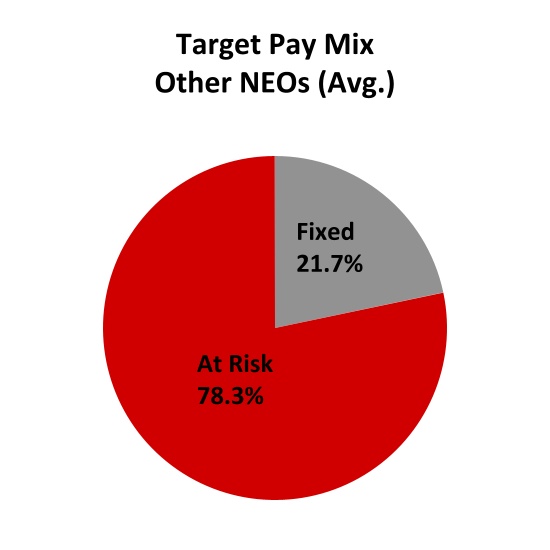

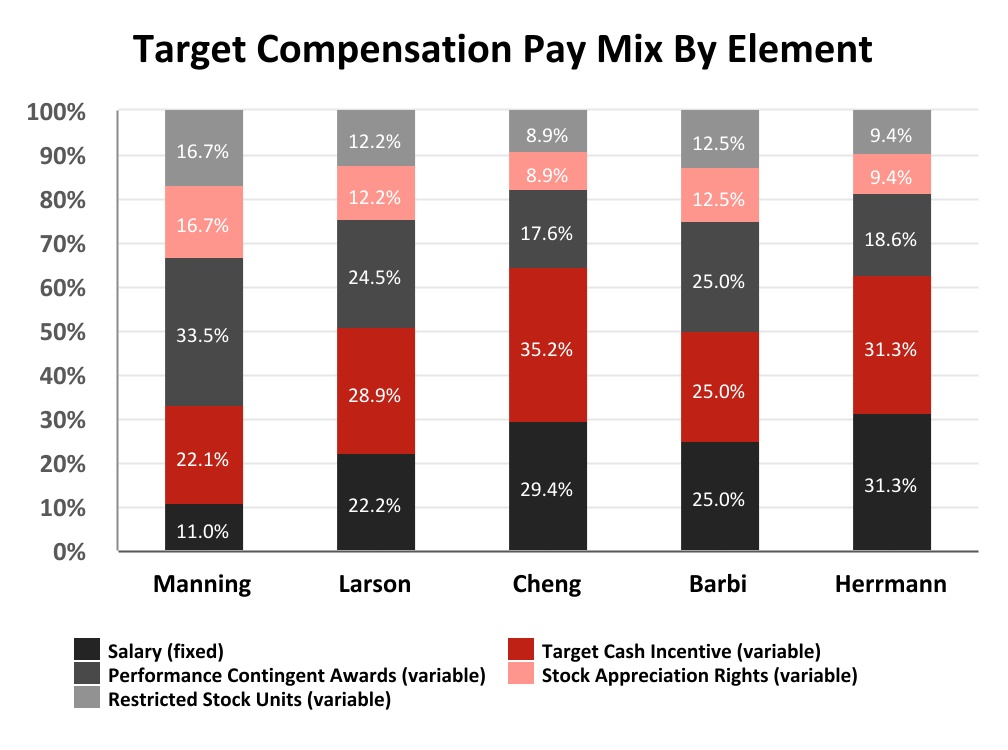

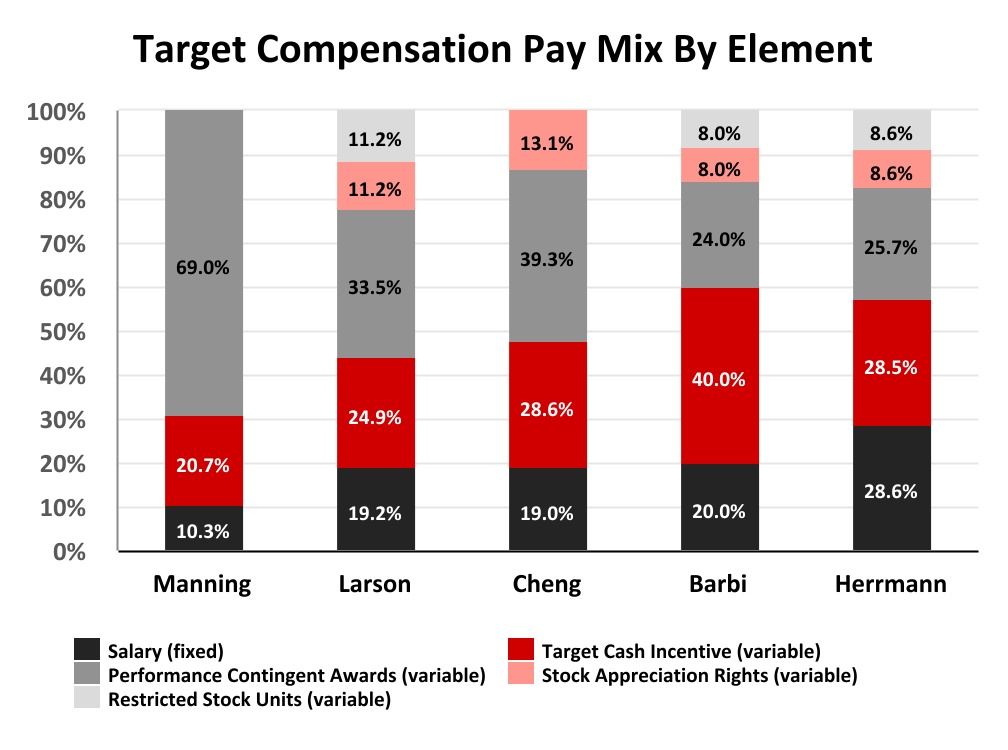

| ● | Represents 23.8%19.4%* of the average named executive officer target total compensation for 2022.2023. |

| 2. | Annual Bonus

Plan | Cash | ● | Serves as an annual performance incentive to achieve established business goals. |

| ● | Tied to one or more of the following factors: overall Company performance, performance of the participant's division or business unit and individual performance. |

| ● | Performance goals established in the first quarter of each year with financial goals of each business unit aligning to corporate goals. |

| ● | Payouts range from 0% of target payout to 200% of target payout, depending on performance. |

| ● | The Annual Bonus Plan company-wide objectives were measured using the following components: (i) adjusted operating income per share; (ii) strategic scorecard; (iii) new business embedded value and (iv) annual adjusted consolidated revenue. The strategic scorecard is an assessment of performance in select keyfour focus areas including strategy execution;for 2023: alternative capital; Creation Re; cybersecurity and data loss prevention; DEI and ESG.DEI. See page 43 for a description of those components. |

| ● | Represents 28.5%* of the average named executive officer target total compensation for 2022.2023. |

| 3. | Performance

Contingent

Awards | Equity | ● | Serves as a performance incentive to achieve established long-termintermediate-term financial measures and align our executives’executives' interests with those of our shareholders. |

| ● | Performance goals established at the beginning of each three-year cycle and fully vest after three years. |

| ● | Payouts range from 0% of target payout to 200% of target payout, depending on Company performance. |

| ● | Due to the impact of the COVID-19 pandemic on the Company's 2020 and 2021 financial results, Company financial performance for the 2018-2020, 2019-2021 and 2020-2022 performance contingent share ("PCS") performance periods was below the threshold required for payment with respect to each of the three metrics, resulting in a zero payout overall for each of these three performance cycles. |

● | PCS grants represent 50% of long-term incentive compensation grants for 2021 and 2022. For the 2023 PCS grants, PCS represents 100% of the long term compensation grant for the CEO, 75% for the President and 60% for all other named executive officers. |

● | For 2022 and 2023 grants,awards, the Company is measuringmeasured financial performance over a three-year period, consistent with historical practice. Performance is based on (i) three-year average adjusted return on equity and (ii) three-year book value per share, excluding accumulated other comprehensive income, growth rate. Results may be modified up or down by a maximum of 10% based on three-year relative total shareholder return. Targets established for the 2022 grant have beenwere adjusted for impacts of Long-Duration Targeted Improvements ("LDTI") under new GAAP accounting rules effective January 1, 2023. |

| ● | For the 2023 PCS grants, PCS represents 100% of the long-term compensation grant for the CEO, 75% for the President and 60% for all other named executive officers. |

| ● | Performance contingent awards represented 23.9%38.3%* of the average named executive officer target total compensation for 2022.2023. |

| 4. | Stock Based

Awards | Equity | ● | Intended to motivate performance, promote appropriate risk-taking, align our named executive officers' long-term interests with shareholders' interests and promote retention. |

| ● | Stock appreciation rights vest 25% per year, on December 31 of each year. |

| ● | Restricted Share Units cliff-vest after a three year period. |

| ● | Restricted share units represented 11.9%5.6%* of the average named executive officer target total compensation for 2022.2023. |

| ● | Stock appreciation rights represented 11.9%8.2%* of the average named executive officer target total compensation for 2022.2023. |

| 5. | Retirement and Pension Benefits | Deferred Cash | ● | Intended to provide a competitive level of post-employment income as part of a total rewards package that supports our ability to attract and retain key members of our management. |

| ● | In the U.S. there are two types of plans: qualified plans and non-qualified plans. |

| ● | Qualified plans are provided to eligible employees up to specified maximum amounts as determined by federal tax authorities. |

| ● | Non-qualified plans are provided to eligible employees who earn compensation above the maximum amounts established by federal tax authorities. |

| ● | Hong Kong retirement and pension benefits are split between: (i) a mandatory provident fund where employees and employer contribute up to a maximum amount and (ii) a supplementary fund for compensation in excess of the maximum amount applicable to the mandatory provident fund benefit. |

| *Calculation excludes pension and retirement benefits. Average percentages are rounded. |

| | | | | |

The performance contingent awards and the stock-based awards described above collectively form the Company's long-term incentive ("LTI") plan. For 2021 and 2022, the LTI grants for named executive officers comprised of 50% PCS, 25% RSUs and 25% SARs. For 2023, the LTI was allocated as follows:

•100% PCS for Ms. Manning;

•75% PCS and 25% SARs for Mr. Cheng; and

•60% PCS, 20% RSUs and 20% SARs for all other named executive officers.

The structure of the 2023 LTI award for Ms. Manning took into consideration that 2023 will bewas her last year as Chief Executive Officer.

2024 Compensation Changes (page 53) In March 2024 the Human Capital and Compensation Committee approved the following changes to the Company's compensation programs:

•The design of the Annual Bonus Plan was changed to utilize an enterprise pool plan design. The Company will use a top-down pool design, where funding is driven by performance against key financial and non-financial metrics at the Company level.

•The total shareholder return modifier for determining payouts for performance contingent awards was increased from 10% to 20% to continue to strengthen alignment for long-term incentive compensation with the experience of our shareholders.

•Stock appreciation rights and restricted stock unit grants will now vest ratably over a three-year term. Previously, stock appreciation rights vested ratably over four years and restricted stock units cliff-vested after three years.

PROXY STATEMENT

INFORMATION ABOUT THE ANNUAL MEETING

The Board of Directors of Reinsurance Group of America, Incorporated (the "Company") is making this proxy solicitation in connection with the Company's 2023 Annual Meeting of Shareholders to be held at 2:00 p.m. CDT on May 24, 2023, and all adjournments and postponements thereof. The Company is first making available the Company's Annual Report to Shareholders for the year ended December 31, 2022 and this Proxy Statement on April 13, 2023.

The solicitation will primarily be by Internet and mail and the expense thereof will be paid by the Company. In addition, proxies may be solicited by directors, officers or employees of the Company in person, or by telephone, facsimile transmission or other electronic means of communication. To aid in the solicitation of proxies, we have retained MacKenzie Partners, which will receive a fixed fee of approximately $15,000, in addition to the reimbursement of out-of-pocket expenses, for its performance of certain administrative services related to the solicitation. MacKenzie Partners will not make any recommendation to the shareholders regarding the approval or disapproval of any voting matters.

The close of business on March 31, 2023 has been fixed as the record date for the determination of the Company shareholders entitled to vote at the Annual Meeting. As of the record date, approximately 66,540,466 shares of common stock were outstanding and entitled to be voted at the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING

The Company's Notice of Annual Meeting, 2023 Proxy Statement and 2022 Annual Report to Shareholders are available on the Company's website at www.rgare.com. Information on our website does not constitute part of this Proxy Statement.

BOARD OF DIRECTORS

ITEMItem 1 – ELECTION OF DIRECTORSElection of Directors

The first item to be acted upon at the Annual Meeting is the election of the following director nominees to the Company's Board of Directors, each with a term ending at the Company's 20242025 annual meeting of shareholders:

| | | | | | | | |

| Name | Director Since | Independent |

| Pina Albo | 2019 | Yes |

| Michele Bang | 2023 | Yes |

| Tony Cheng | 2023 | No |

| John J. Gauthier | 2018 | Yes |

| Patricia L. Guinn | 2016 | Yes |

Anna Manning | 2016 | No |

| Hazel M. McNeilage | 2018 | Yes |

| George Nichols III | 2022 | Yes |

| Stephen O'Hearn (Chair) | 2020 | Yes |

| Alison Rand | 2024 | Yes |

| Shundrawn Thomas | 2021 | Yes |

| Khanh T. Tran | 2022 | Yes |

| Steven C. Van Wyk | 2019 | Yes |

The Board nominates each of these individuals for election at the Annual Meeting. Each nominee is currently a member of the Board. All director nominees stand for election for a one-year term. Should any one or more of the nominees be unable or unwilling to serve (which is not expected), the proxies will be voted for such other person or persons as the Board may recommend unless such proxies are marked otherwise.

See "Board of Directors and Corporate Governance" beginning on page 11 for further information related to "Item 1 - Election of Directors." Vote Required

The vote required to elect each director is a majority of the common stock represented in person or by proxy at the Annual Meeting and entitled to vote on this matter.

Recommendation of the Board of Directors

The Board of Directors recommends a vote FOR all nominees for election as a director.

Item 2 – Shareholders' Advisory Vote on Executive Compensation

The Dodd-Frank Act enables our shareholders to vote to approve, on an advisory basis (i.e., non-binding), the compensation of the named executive officers as disclosed in this Proxy Statement

pursuant to Item 402 of Regulation S-K (including in the Compensation Discussion and Analysis section, compensation tables and accompanying narrative disclosures).

The Company has a "pay-for-performance" philosophy that forms the foundation of all decisions regarding compensation of the named executive officers. This compensation philosophy, and the program structure approved by the Human Capital and Compensation Committee (the "Committee"), is central to our ability to attract, retain and motivate individuals who can achieve superior financial results. Please refer to "Compensation Discussion and Analysis – Overview of Compensation Practices" for further discussion of the compensation of the named executive officers. A primary focus of the Committee is whether the Company's executive compensation program serves the best interests of the Company's shareholders. At the Company's 2023 Annual Meeting, 95% of votes cast on the proposal approved the compensation program described in the proxy statement for that meeting.

| | |

| 2023 Say on Pay Votes |

| Percentage of Votes Cast in Favor of "Say on Pay" |

| 95% |

At the Company's 2022 Annual Meeting, 62% of votes cast on the proposal approved the compensation program described in the proxy statement for that meeting. As a result, the Company engaged in the extensive shareholder outreach efforts described in last year's proxy statement to obtain feedback from our shareholders. We adjusted our compensation structure and disclosures in light of that feedback. Prior to 2022, shareholder feedback at our previous annual meetings was uniformly positive as reflected in the following table:

| | | | | |

| Say on Pay Votes (2012-2021) |

| Annual Meeting Year | Percentage of Votes Cast in Favor of "Say on Pay" |

| 2021 | 95% |

| 2020 | 98% |

| 2019 | 98% |

| 2018 | 98% |

| 2017 | 98% |

| 2016 | 98% |

| 2015 | 98% |

| 2014 | 97% |

| 2013 | 99% |

| 2012 | 96% |

| Ten Year Average | 97.5% |

We are asking our shareholders to approve the compensation of the named executive officers as disclosed in this Proxy Statement, including the "Compensation Discussion and Analysis" and "Compensation Tables" discussions. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the named executive officers and the policies and practices described in this Proxy Statement. This vote is advisory and therefore not binding on the Company, the Committee or the Board. However, the Board and the Committee value the opinions of our shareholders and to the extent there is any significant vote against the named executive officer

compensation as disclosed in this Proxy Statement, we will carefully consider those shareholders' concerns when making future compensation decisions for the named executive officers and will evaluate whether any actions are necessary to address those concerns.

Vote Required

The vote required to approve this Item 2 is a majority of the common stock represented in person or by proxy at the Annual Meeting and entitled to vote on this matter.

Recommendation of the Board of Directors

The Board of Directors recommends that shareholders vote FOR the proposal to approve the compensation of the named executive officers, as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion.

Item 3 – Approval of Employee Stock Purchase Plan

Overview

On March 7, 2024, upon the recommendation of the Human Capital and Compensation Committee (the "Committee"), our Board of Directors approved the adoption of the Reinsurance Group of America, Incorporated Employee Stock Purchase Plan (the "ESPP"), subject to shareholder approval in accordance with NYSE listing standards. If the shareholders of the Company do not approve the ESPP, the ESPP will not become effective.

We intend for the ESPP to offer a convenient means for employees of the Company (excluding our Section 16 officers) who might not otherwise purchase and hold our common stock to do so, and for the matching stock purchase feature as described below to provide a meaningful incentive to participate. We believe that the opportunity for these employees to acquire a proprietary interest in the Company through the purchase of shares of common stock and this matching feature will assist in attracting, retaining and rewarding employees, and strengthen the mutuality of interest between our employees and Company shareholders.

The ESPP is not intended to qualify as an "employee stock purchase plan" under Section 423 of the Internal Revenue Code of 1986, as amended (the "Code").

Materials Terms of ESPP

The material features of the ESPP are summarized below. The following summary of the ESPP does not purport to be a complete description of all of the provisions of the ESPP, and is qualified in its entirety by reference to the complete text of the ESPP, a copy of which is attached as Appendix A to this proxy statement.

Administration. The ESPP shall be administered by a committee appointed by our Board of Directors, which shall initially be the Human Capital and Compensation Committee of the Board (the "Administrator"). Any power of the Administrator may also be exercised by the Board. The Administrator will have broad authority pursuant to the terms of the ESPP, including full and exclusive discretionary authority to construe, interpret and apply the terms of the ESPP, and such other duties and responsibilities set forth in the ESPP. All determinations made by the Administrator, to the fullest extent permitted by applicable law, will be final and binding upon all participants. In addition, to the extent permitted by applicable law, the Administrator may delegate its responsibilities under the ESPP to one or more officers or any subcommittee of the Administrator. In addition, the Administrator may retain

any third-party broker-dealer, financial institution, clearing agent, transfer agent or other agent to perform such functions in connection with the ESPP as deemed appropriate by the Administrator.

Shares Available under ESPP. A total of 100,000 shares of common stock of the Company are initially authorized and reserved for issuance under the ESPP. The number of shares available under the ESPP are subject to adjustment as described below under "Adjustments Upon Changes in Capitalization." As of April 3, 2024, the closing price of our common stock as reported on the NYSE was $193.60 per share.

Eligibility; Participation. All employees of the Company and any Designated Subsidiary (as defined below) are eligible to participate in the ESPP, except for any employee (i) who is an "officer" as defined in Rule 16a-1(f) under the Exchange Act, or (ii) who is not eligible to participate in the ESPP pursuant to the laws of a foreign jurisdiction. In addition, consultants and non-employee directors of the Company will not be eligible to participate in the ESPP. For purposes of the ESPP, a "Designated Subsidiary" means any subsidiary of the Company that has been designated by the Administrator from time to time in its sole discretion as eligible to participate in the Plan. As of March 1, 2024, approximately 3,000 employees of the Company would have been eligible to participate in the ESPP if the ESPP had been in operation on such date based on the Company's expectations for eligibility in the initial Offering Period (as defined below).

The Company, through its subsidiaries, employs people in various countries and intends to implement participation in the ESPP on a rolling basis, following analysis of relevant regulations in each applicable jurisdiction. In addition, the Plan provides that the Administrator may establish one or more sub-plans of the Plan to provide benefits to employees of Designated Subsidiaries located outside the United States in a manner that complies with local law.

Offering Periods. The ESPP will be implemented by offerings of purchase rights during offering periods ("Offering Periods") as determined by the Administrator. Offering Periods will commence at such times as determined by the Administrator, and will last six months unless a different term is determined by the Administrator. Under the ESPP, any Eligible Employee as of the commencement of any Offering Period who has elected to participate in the ESPP by following the enrollment procedures set forth in the ESPP will have the right to acquire shares of our common stock at the end of the Offering Period in accordance with the terms of the ESPP.

Contributions.To participate in the ESPP, a participant must authorize contributions, which will generally be collected through payroll deductions from the participant's base salary. Such payroll deductions will represent a fixed percentage of the base salary of such participant equal to 2% to 10% of base salary, as determined by the participant. Each participant who has elected to participate in the ESPP is automatically granted a purchase right on the first day of the Offering Period to purchase shares of common stock, which purchase right will be exercised as set forth below under "Purchase Date."

In addition, a participant is not permitted to make contributions to purchase shares of common stock pursuant to the ESPP in excess of $15,000 (or such other amount determined by the Administrator) in any calendar year.

Offering Period Mechanics. Any Eligible Employee may participate in the ESPP for any Offering Period by, at least 10 business days prior to the first day of the Offering Period (or such other period determined by the Administrator), submitting a properly completed subscription agreement authorizing contributions and/or completing such documentation and following such procedures as prescribed by the Administrator.

A participant may cease making contributions during any Offering Period by following the procedures set forth in the ESPP. In such event, the participant may not make any further contributions during such Offering Period. In addition, a participant may reduce (but not increase) such participant's contribution percentage at any time during any Offering Period, provided that only one such reduction may be made during any Offering Period. Except as set forth above, unless otherwise determined by the

Administrator, participants are not allowed to change the amount of their contributions during any Offering Period.

In addition, a participant may withdraw all, or less than all, of a participant's contributions during any Offering Period (provided, that a participant may not make more than one such withdrawal during any Offering Period), in which case all accumulated compensation deductions of such participant subject to such withdrawal request will be returned to such participant, without interest. In the event of any such withdrawal, such participant's purchase right for the Offering Period will be automatically terminated, and no further contributions may be made by such participant for the Offering Period in which such withdrawal occurs.

Unless a participant has ceased making contributions to the ESPP as set forth above, has withdrawn such participant's contributions in the ESPP as noted above, or is no longer an Eligible Employee, a participant in the ESPP in any Offering Period will continue to participate in the ESPP in future Offering Periods at the then existing contribution level of participant unless such participant has affirmatively changed such contribution level.

Purchase Date.Unless a participant has withdrawn all of such participant's contributions in the ESPP as noted above during an Offering Period or is no longer an Eligible Employee, a participant will generally acquire shares of common stock on the last trading day of the Offering Period (the "Purchase Date"). In such event, on the Purchase Date, (i) contributions for each participant will be used to purchase whole shares of the Company's common stock at a purchase price equal to the closing trading price of our common stock on the Purchase Date, and (ii) the Company will issue the Matching Common Stock to participant in connection therewith (as defined and described below).

Matching Common Stock.On any Purchase Date on which a participant purchases shares of common stock as set forth above, the Company will issue to such participant shares of common stock (the "Matching Common Stock") which will equal 25% (or such lower percentage, as may be determined by the Administrator) of the shares purchased by participant on such Purchase Date.The Matching Common Stock will be subject to a risk of forfeiture, andunless otherwise determined by the Administrator, in the event a participant ceases to be an employee of the Company for any reason prior to the end of the restricted period with respect to such Matching Common Stock (which, unless otherwise determined by the Administrator, will be the first anniversary of the Purchase Date upon which the Matching Common Stock was issued), the Matching Common Stock on such Purchase Date shall be forfeited without any consideration.

Termination of Employment.At such time that the employment of any participant terminates or such individual otherwise ceases to be an Eligible Employee, for any reason, such participant will be deemed to have elected to immediately withdraw from the ESPP and the contributions credited to such participant's notional account under the ESPP but not yet used to purchase shares of Common Stock under the Plan will be returned to such participant.

Transferability. Rights to purchase shares of our common stock under the ESPP, and contributions in a participant's account, may not be transferred by a participant and may be exercised only by the participant, subject to certain exceptions in connection with the death of a participant as provided under the terms of the ESPP.

Rights as a Shareholder; Dividends on Matching Common Stock.A participant will have the rights and privileges of a shareholder of the Company when, but not until, shares have been issued and delivered to such participant following exercise of such participant's option on the Purchase Date.In addition, in the event a dividend by the Company is paid in respect of any Matching Common Stock priorto the first anniversary of the Purchase Date upon which such Matching Common Stock was issued, then such dividends will not bepaid on such Matching Common Stock unless and until the participant continues employment through such first anniversary.

Adjustments Upon Changes in Capitalization.In the event of any dividend or other distribution (whether in the form of cash, Common Stock, other securities, or other property, but excluding normal cash dividends), recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase, or exchange of Common Stock or other securities of the Company, orother change in the corporate structure of the Company affecting the Common Stock, the Administrator, in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the ESPP, shall, in any such manner as it deems equitable, appropriately adjust the number and class of shares available under the ESPP and the applicable purchase price of such shares.

Change in Control.In the event of any sale of all or substantially all of the assets, merger or similar transaction involving the Company, except as provided below, any outstanding purchase rights will be assumed or an equivalent option may be substituted by the successor.Alternatively, in such event, if the successor entity refuses to assume or substitute for such purchase rights, or if so determined by the Administrator, the Administrator may shorten the Offering Period so that the last day of such shortened Offering Period will occur prior to the date of the completion of such transaction in accordance with the terms of the ESPP.

Effective Date.The ESPP will be effective on May 22, 2024, provided that the ESPP has been approved by our shareholders on such date.

Amendment and Termination.Our board may amend, alter, suspend, discontinue or terminate the ESPP in any respect at any time, provided that the ESPP may not be amended without approval of our shareholders if such approval is necessary to comply with any applicable laws (including the rules of the NYSE) for which or with which the Administrator deems it necessary or desirable to comply.

New Plan Benefits

No purchases have been made at this time under the ESPP as the result of the fact that the ESPP is not yet in effect and is subject to shareholder approval.Participation in the ESPP is voluntary, and benefits under the ESPP will depend on employees' elections to participate and the fair market value of our common stock at various future dates.Accordingly, future benefits or amounts that will be received under the ESPP by employees of the Company are not currently determinable.In addition, as noted above, directors and Section 16 officers of the Company will not be eligible to participate in the ESPP.

U.S. Federal Income Tax Consequences

The following discussion is a brief summary of certain U.S. federal income tax aspects associated with the issuance of shares of common stock (including Matching Common Stock) under the ESPP based upon the U.S. federal income tax laws in effect on the date hereof. This summary is provided only for general information and is not intended to be exhaustive. The exact U.S. federal income tax consequences to any participant will depend upon his or her particular circumstances and other factors. Participants may also be subject to certain other U.S. federal, state or local, or non-U.S. taxes, which are not described herein. This summarized tax information is not tax advice, and participants in the ESPP are encouraged to consult their own tax advisors with respect to such other tax considerations or particular U.S. federal income tax implications of shares acquired under the ESPP.As noted above, the ESPP is not intended to qualify as an "employee stock purchase plan" under Section 423 of the Code (a "Section 423 Plan"). Accordingly, certain tax benefits available to participants in a Section 423 Plan will not be available under the ESPP.

For U.S. federal income tax purposes, a participant generally will not recognize taxable income at the beginning of an Offering Period in respect of the grant of the right to purchase and acquire shares under the ESPP, nor will the Company be entitled to any deduction at that time. The amount of a Participant's payroll deductions during an Offering Period will be subject to U.S. federal income tax

withholding at the time the payroll deductions are made. At the end of the Offering Period, a participant generally will not recognize taxable income upon the purchase of shares under the ESPP at their fair market value, nor upon any issuance of Matching Common Stock under the ESPP at that time, and instead will recognize ordinary income in an amount equal to the fair market value of the Matching Common Stock when the risk of forfeiture with respect to the Matching Common Stock lapses at the end of the applicable restricted period as described above under "Matching Common Stock" (unless the participant elects to be taxed at the time of the issuance of the Matching Common Stock pursuant to Section 83(b) of the Code). The Company generally will be entitled to a corresponding deduction at the time the participant recognizes income in respect of the Matching Common Stock.

Upon the subsequent sale or other disposition of any shares acquired under the ESPP, the participant generally will recognize capital gain or loss equal to the difference between the amount realized by the participant on such disposition and the participant's adjusted tax basis in such shares. A participant's adjusted tax basis in shares acquired under the ESPP generally will be the purchase price paid for any purchased shares, or the amount of ordinary income recognized in connection with the issuance of Matching Common Stock.A capital gain or loss will be long-term if at the time of the disposition, the participant has held the shares for more than one year. Unless the participant made an election under Section 83(b) of the Code, the restricted period applicable to any issuance of Matching Common Stock following such issuance is not taken into account for purposes of determining whether the participant has held those shares for more than one year. Long-term capital gain recognized by a participant generally is taxed at preferential rates. The deductibility of capital losses by a participant is subject to limitations.

Vote Required

The vote required to approve this Item 3 is a majority of the shares of common stock represented in person or by proxy at the Annual Meeting and entitled to vote on this matter, which approval will also satisfy the requirement under NYSE rules that the proposal be approved by a majority of the votes cast.

Recommendation of the Board of Directors

The Board of Directors has approved the ESPP and recommends that shareholders vote FOR the proposal.

Item 4 - Ratification of Appointment of Independent Auditor

We are asking shareholders to ratify the appointment of Deloitte & Touche LLP and its related entities (collectively, "Deloitte") as the Company's independent registered public accountant for the current year. The Audit Committee of the Board has appointed Deloitte subject to shareholder ratification.

Representatives of Deloitte will attend the Annual Meeting. They will have an opportunity to make a statement if they desire to do so and they will be available to respond to appropriate questions.

As outlined in the Audit Committee charter, the Audit Committee is responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm retained to audit RGA's financial statements. The Audit Committee annually evaluates the performance of the Company's independent auditor, including the senior audit engagement team, and determines whether to reengage the current auditors or consider other audit firms. Deloitte has served as the independent auditor of the Company since 2000.

The Audit Committee and the Board believe it is in the best interests of RGA and its shareholders to continue to retain Deloitte as RGA's independent registered public accounting firm. Its long-term

knowledge of the Company and its subsidiaries, combined with its insurance industry expertise, has enabled it to carry out its audits of the Company's financial statements with effectiveness and efficiency.

In considering Deloitte's appointment, the Audit Committee reviewed the firm's qualifications and competencies, including the following factors:

•Deloitte's status as a registered public accounting firm with the PCAOB, as required by Sarbanes-Oxley and the Rules of the PCAOB;

•Deloitte's independence and its processes for maintaining its independence;

•the results of the independent review of the firm's quality control system;

•the key members of the engagement team for the audit of the Company's financial statements;

•Deloitte's approach to resolving significant accounting and auditing matters including consultation with the firm's national office; and

•Deloitte's reputation for integrity and competence in the fields of accounting and auditing.

The Audit Committee ensures the mandatory five-year rotation of the audit engagement team partner as required by SEC rules. The lead engagement partner was appointed beginning with the fiscal year 2023 audit.

The Audit Committee also approves Deloitte's audit and permissible non-audit services in advance pursuant to a Pre-Approval Policy. Deloitte submits to the Audit Committee detailed schedules with all of the proposed permitted services within each category, together with estimated fees. The Audit Committee also reviews a schedule of audit-related, tax and other permitted non-audit services that the Company may engage the independent auditor to perform and an estimated amount of fees for each of those services.

Consistent with the Pre-Approval Policy, all audit related services, tax services and other services were pre-approved by the Audit Committee. The Audit Committee concluded that the provision of such services by Deloitte was compatible with the maintenance of that firm's independence in the conduct of its auditing functions.

The aggregate fees billed to us for the years ending December 31, 2023 and 2022 by Deloitte are set forth below.

| | | | | | | | |

| Auditor Fees | | |

| Fee | Fiscal Year |

| 2023 | 2022 |

Audit Fees1 | $15,721,639 | $14,195,133 |

Audit Related Fees2 | 723,581 | 716,181 |

| Total Audit and Audit-related Fees | $16,445,220 | $14,911,314 |

Tax Fees3 | 233,060 | 149,562 |

| Other | — | — |

| Total Fees | $16,678,280 | $15,060,876 |

1. Includes fees for the audit of our Company's and its subsidiaries' annual financial statements, reviews of our quarterly financial statements and Sarbanes-Oxley Section 404 attestation. Approximately $2.5 million and $1.8 million of the total 2023 and 2022 Audit Fees were related to the Company's implementation of LDTI accounting changes, respectively.

2. Includes fees for services rendered by Deloitte for matters such as assistance with internal control reporting requirements, certain accounting consultations on potential acquisition, reinsurance transactions, and services associated with SEC registration statements, periodic reports and securities offerings.

3. Includes fees for tax services rendered by Deloitte such as consultation related to tax planning and compliance.

Vote Required

The vote required to approve this Item 4 is a majority of the common stock represented in person or by proxy at the Annual Meeting and entitled to vote on this matter.

Recommendation of the Board of Directors

The Board of Directors has approved the proposal regarding the appointment of Deloitte and recommends that shareholders vote FOR the proposal.

Vote Requirements

Each share of common stock outstanding at the close of business on the record date is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. Under Missouri corporate law, if a quorum is present, the votes necessary to approve the proposals are as follows:

| | | | | | | | |

| Voting Matters |

| Item | Proposal | Vote Required to Adopt the Proposal |

| 1. | Election of Directors | The vote required to elect each director is the affirmative votes of the holders of a majority of the common stock entitled to vote thereon which are present in person or represented by proxy at the Annual Meeting. |

| 2. | Shareholders' Advisory Vote on Executive Compensation | The vote required to pass this proposal is the affirmative votes of the holders of a majority of the common stock entitled to vote thereon which are present in person or represented by proxy at the Annual Meeting. |

| 3. | Approve the RGA Employee Stock Purchase Plan | The vote required to pass this proposal is the affirmative votes of the holders of a majority of the common stock entitled to vote thereon which are present in person or represented by proxy at the Annual Meeting. |

| 4. | Ratification of Appointment of Independent Auditor | The vote required to pass this proposal is the affirmative votes of the holders of a majority of the common stock entitled to vote thereon which are present in person or represented by proxy at the Annual Meeting. |

Under Missouri corporate law, the approval of any action taken at the Annual Meeting requires the affirmative vote of a majority of the votes entitled to vote on any such action which are present or represented by proxy at the Annual Meeting. Abstentions will be counted in connection with determining the number of shares represented at the Annual Meeting for quorum purposes. In addition, any abstentions with respect to any of the above items will have the same effect as if the shares represented thereby, as applicable, were voted against any nominee or nominees with respect to Item 1, and against the proposals with respect to Items 2, 3 and 4.

Broker non-votes, while counted for general quorum purposes, will have no effect on the voting results for any non-discretionary matter.As such, if a broker indicates on the proxy that it does not have discretionary authority as to certain shares to vote on a particular matter, those shares will not be considered as present and entitled to vote with respect to that matter and thus will have no effect on the outcome of the vote with regard to such matters.The election of directors (Item 1), the advisory vote on the compensation of the Company's named executive officers (Item 2), and the proposal to approve the ESPP (Item 3) are considered non-discretionary items, and as such brokers cannot vote uninstructed shares on your behalf in these matters. For your vote to be counted on these matters, you must submit your voting instruction form to your broker. Conversely, the ratification of the independent auditor (Item 4) is a discretionary item such that, if your shares are held through a broker, that person will have discretion to vote your shares on that matter if you fail to provide instructions.For

additional information, see "Other Matters - Question and Answers about the Annual Meetings" under "What is a Broker Non-Vote?".

We know of no other matters to come before the meeting. As set forth in "Other Matters," our organizational documents require that advance notice be provided of any proposal intended to be presented at the Annual Meeting. The deadline for this notice has passed, and we did not receive any such notice. As such, if any other matters properly come before the meeting, the proxies solicited hereby will be voted on such matters in accordance with the judgment of the persons voting such proxies. Voting results will be disclosed in our Current Report on Form 8-K filed with the SEC within four business days following the Annual Meeting.

Board of Directors and Corporate Governance

Board of Directors

Board Composition

Each of the nominees standing for election has a core set of skills, talents and attributes that make them valuable members of our Company's Board. When searching for new Board candidates, the Nominating and Governance Committee considers the evolving needs of the Company's global business and searches for Board candidates who fill any current or anticipated needs or gaps in skills, experience and overall Board composition.

The Nominating and Governance Committee of the Board has determined that all of our nominees should possess the following qualifications:

| | | | | |

| Director Qualifications | |

| Director Qualification | Description |

Commitment to

Our Values | Directors and candidates should be committed to promoting the Company's financial success and preserving and enhancing our business and ethical reputation, as embodied in our codes of conduct and ethics. |

| Diversity | Directors and candidates should reflect a diversity of viewpoints, background, work and other experiences (including military service), and other demographics, such as race, gender identity, ethnicity, sexual orientation, culture and nationality. |

| Financial Literacy | Directors and candidates should be "financially literate" as such qualification is interpreted by the Board in its business judgment. |

| Independence | Directors and candidates should not have any conflicts of interest or other commitments that would prevent such director from fulfilling the obligations of a director. Mr. Cheng, as our President and Chief Executive Officer, is not independent. |

Knowledge and

Experience | Directors and candidates should possess knowledge and experience that will complement that of other directors and promote the creation of shareholder value. |

Leadership

Experience | Directors and candidates should possess significant leadership experience, such as experience in business, finance/accounting, financial services regulation, education or government, and shall possess qualities reflecting a proven record of accomplishment and ability to work with others. |

Reputation and

Integrity | Directors and candidates should be of high repute and recognized integrity and not have been convicted in a criminal proceeding (excluding traffic violations and other minor offenses). |

| Other Factors | Directors and candidates should have such other qualifying and desirable characteristics as identified by the Nominating and Governance Committee from time to time. |

Other areas of expertise or experience are desirable given our Company's global reinsurance business and operations, including: life insurance, actuarial science, financial services, information technology, cybersecurity, data privacy and security, international markets, operations, capital markets, investments, banking, risk management, human capital management and sustainability.

Changes in Directors

Effective JulyOn October 1, 2022, Khanh T. Tran2023, Michele Bang was appointed to the Board of Directors. Mr. Tran was the President and Chief Executive Officer of Aviation Capital Group LLC, a top 10 global commercial aviation leasing company until his retirement in 2020.

Effective January 4, 2023, Tony Cheng was appointed to the Board of Directors. Mr. Cheng is the Company's President and is expected to become the Company's Chief Executive Officer upon Ms. Manning's retirement on December 31, 2023.

On March 9, 2023, Ng Keng Hooi informed the Company that he will not stand for re-election as a member of the Board atBoard. Ms. Bang is the annual meetingformer Deputy Chief Executive Officer of shareholders. Mr. Ng's decision not to stand for re-election is notEastspring Investments, the resultAsia asset management arm of any dispute or disagreementPrudential plc. During her time with Prudential she served as the Company,executive team member that drove digital innovation and technology integration throughout the Company's management or the Board on any matter relating to the Company's operations, policies or practices.firm.

Board Chair

As previously reported, Mr. Cliff EasonAnna Manning retired as Chair of the BoardCompany's Chief Executive Officer and as a director on December 31, 2022. Board2023.

On April 1, 2024, Alison Rand was appointed as a member Stephen T. O'Hearn assumed the duties of Chair of the Board effective January 1, 2023.

Director Nominees

The Board currently has twelve directors, elevenBoard. Ms. Rand is the former Executive Vice President and Chief Financial Officer of which are standing for electionPrimerica, Inc. While at the Annual Meeting. All director nominees stand for election for a one-year term. Certain information with respect to the director nominees proposed by the Company is set forth below.

Vote Required

If a quorum is present, the vote required to elect each director is a majority of the common stock represented in person or by proxy at the Annual Meeting. The Company recommends a vote FOR all nominees for election to the Board.

| | | | | |

Pina Albo | |

| Business Experience: Ms. Albo is the Chief Executive Officer of Hamilton Insurance Group ("Hamilton"), a Bermuda-based holding company for Hamilton Re, a global specialty insurer and property and casualty reinsurer. Prior to joining Hamilton, she spent 25 years at Munich Re, starting as a claims expert and holding increasingly senior positions that culminated in roles as President, Reinsurance Division, Munich Re America and later Member of the Board of Executive Management. She began her career as a lawyer after having earned law degrees in both Canada and France. Ms. Albo currently serves as Chair of the board of directors for the Association of Bermuda Insurers and Reinsurers.

|

Chief Executive Officer of Hamilton Insurance Group | Age: 60

Director since: 2019

Independent

|

| | | | | |

Tony Cheng | |